How to Hack Through the Bullshit to get to A-HA!

Math, however, is a whole different story. People say that numbers don’t lie. That’s cute. Numbers certainly can lie and often do.

Business is all about numbers. Building numbers up is hard. Studying them is easy. Usually, you get some variation of what you expect. When you don’t, you run through three stages, “Huh?”, “WTF?”, and finally, “A-HA!”.

I went through the entire cycle recently. It was an eye-opener.

CAVEAT: As you read this, you may think you know the subject and want to go watch funny cat videos instead. Don’t. Mark Twain said, “It ain’t what you don’t know that’ll hurt you. It’s what you know for sure that just ain’t so!”

This is one of those things.

Starting at the, “Huh?”

My journey started over a month ago when one of my Customer Experience Group clients called in a huff.

“Paulo, I want you to check something out for me. Three {expletive deleted}ing guys are telling me my {expletive deleted}ing bank is screwing me. They make sense but they’re {expletive deleted}ing creeping me the {expletive deleted} out! I feel like I’m in a {expletive deleted}ing remake of the {expletive deleted}ing “Wolf of {expletive deleted}ing Wall Street!”

In all the time I’ve known him, he never swore, not even once. Now, he drops seven f-bombs in one sentence?

That was the first, “Huh?”

The second, “Huh?” was what he wanted me to look into. . . payment processing fees for credit and debit cards, plus ApplePay and Android Pay.

What was there to look into? Surely this stuff is so basic that there's nothing to look into.

That’s when I remembered the Mark Twain quote. We get complacent when faced with what we consider familiar. Very few things are as familiar as our ubiquitous plastic friends. I think Eve charged the infamous apple to her VISA.

Okay, maybe not.

Familiarity breeds ennui. Complacency is natural. I was no exception. I asked him to send me his most recent statement so I could compare it to mine.

Moving on to, “WTF?”

First, I want to go on record as saying my client’s bank was not “screwing” him. Banks don’t generally do that sort of thing. They don’t even process payments directly.

His statement arrived in minutes. Since he processes over 30 times what I process, I expected his rates to be less than mine. Since he processes face-to-face transactions and I process web sales, I expected his fees to be much less than mine

They weren’t. They were lower, yes, but not by much.

WTF? I dug deeper.

I called several other clients and asked for their statements. I looked at . . .

- A B&B (a friend) with $40 thousand in annual processing

- An exterminator (my neighbor, not a client) with $110 thousand in annual processing

- A clothing boutique with $500 thousand in annual processing

- A group of pizzerias with $1.8 million in annual processing

- The initial client (fast food) with $3 million in annual processing

- A casual dining restaurant with $8 million in annual processing

- A boutique hotel with $9 million in annual processing

- A fine dining restaurant with $11 million in annual processing

- A little chain of gas stations with $22 million in annual processing

- A fine dining restaurant with $40 million in annual processing

To simplify my initial study, I just looked at the effective rate. I took the difference between what was processed and what was deposited and divided that by the amount processed. There are over 900 processing codes (interchanges) between Canada and the US. I didn’t want to dive that deeply just yet.

WTF #2

I expected fees to run in a fairly straight line based on the amount processed. Logic says that $40 million speaks louder than $40 thousand. I also expected that there may be a marked variance based on the industry.

There was no rhyme or reason to the rates. The initial client paid the same rate (within a few basis points) as the $40 million (#10) restaurant. The casual dining restaurant (#6) paid substantially less than anyone else, except the gas stations. It was no surprise that the B&B (#1) paid the most. What was surprising was that the hotel (#7) paid just a little less than the B&B, and more than the exterminator (#2) who only processes 1% as much!

WTF indeed.

WTF #3

There were obviously other factors in play. Before digging deeper and factoring in all those 900+ codes, I decided to contact the “three {expletive deleted}ing guys” who first contacted my client. Bear in mind that I was now contacting them representing not only my initial client’s $3 million in billing but with damned close to $100 million in annual business.

I expected cooperation.

I expected a consultative approach.

I would have settled for bored indifference.

Instead, I understood the “Wolf of Wall Street” reference. One of the “{expletive deleted}ing guys” actually told me to either send back the signed agreement or f-off.

I chose to f-off.

Yet another WTF.

Finally, the A-Ha!

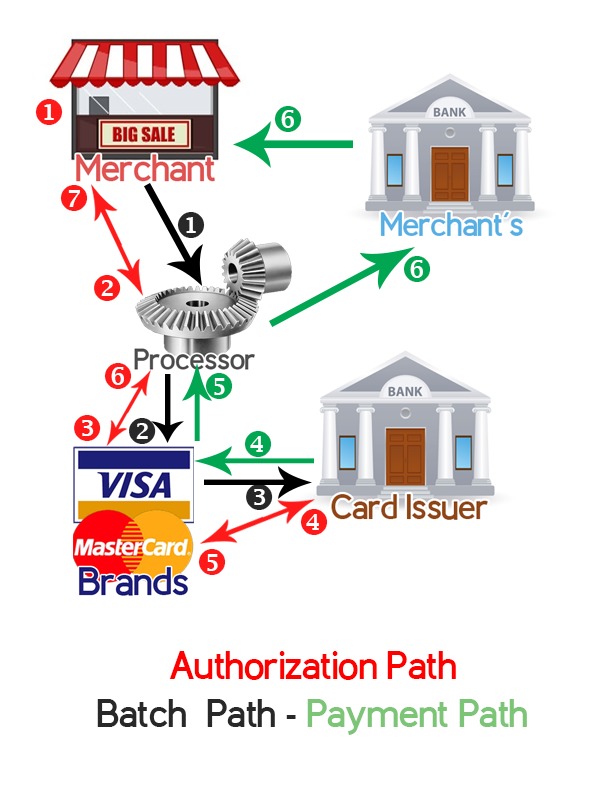

- Mary buys a pair of shoes from Bob’s Shoe Store using her Visa

- Bob’s Shoe Store sends an authorization request to its processor, a.k.a. acquirer.

- The processor receives the request and sends it to the card brand, here Visa.

- The card brand passes the request along to the issuing bank, that’s the bank whose name is on Mary’s Visa card.

- The issuing bank checks that Mary’s account is in good standing and sends the authorization code back to the card brand, Visa. The issuing bank also puts a hold on Mary’s account for the amount of the purchase.

- The card brand sends the authorization back to the processor.

- The processor sends the authorization back to the merchant.

- Bob hands Mary her shoes.

So far, no actual funds have changed hands, except maybe a tiny authorization fee. The transaction only exists on “paper.” Bob needs to close or batch-out his sales. The closing process might look like this (black path outgoing, green path incoming).

- Bob’s terminal or POS sends the day’s transactions to the processor.

- The processor sends the transaction information to the appropriate card brands.

- The card brands send the transactions to the appropriate issuing banks.

- The issuing banks confirm the authorizations, hold back their interchange fees (there are over 900 possible fee codes in North America) and transfer the funds back to the card brands

- The card brands take their assessment fee and send the funds along to the processor.

- The processor takes its cut, as set out in the merchant agreement, and deposits the funds to the merchant’s bank account.

The “A-HA!” lies in that last step in the batching process. It also explains many WTFs. Processors can have ISOs, (Independent Sales Organizations/Outlets/Offices) and ISAs (Independent Sales Agents). That’s both the opportunity and the problem.

Processors are finicky about whom they accept as ISOs, but ISOs can sub to other ISOs. There are even ISOs of ISOs of ISOs of ISOs of ISOs etc. etc. Every step is a lower level of finickiness. That’s when the system can look like the "Wolf of Wall Street." That’s what led one of my contacts to remark, “Companies that do this are a dime a dozen.”

Even the guy who does the linen service for the B&B offers payment processing. That seems like a good fit (not!).

The WTFs just keep on coming.

Those of you who know me well know that I’m pretty good at figuring out complex issues. It took me over 300 hours to really figure this stuff out starting from a well-developed base. I don’t think the linen guy can say the same.

My solution

It seems to me that an ISO manned by professional people who employ a soft-sell, consultative, no-BS approach would be a viable addition to our services. All I need to do is choose a processor partner. That partner needs to fill very specific holes.

- Customer Service: Ideally 24/7 multilingual with minimal wait times. I hate waiting and don’t want my clients to wait either. My clients all have my cell phone number.

- I’m a tech guy. The partner needs to have some serious back-end support/reporting for our mutual clients. At the very least, they would need a strong API so we can create whatever is needed. Ideally, they should have both.

- The ability for us to monitor client activity to make sure everything runs smoothly

- Geographical Limits: I have clients on all continents except Antarctica. At a minimum, whomever I choose needs to handle Canada and the USA.

- Pricing Flexibility: No duh. That’s why I’m even looking at this

- Integration: It should easily integrate with most existing POS and PMS systems

- Value-Add: It should integrate to gift card/loyalty card systems, cheque clearing systems, merchant cash advances, etc..

- It should have or allow me to create, specific plans for franchise systems. They have funky needs.

You’ll note that ISO remuneration structure isn’t even a consideration. That’s because it isn’t. I learned long ago that I get what I need by helping other people get what they need.

My promise to you

If you accept plastic, reach out. If I can help, I will. If you need help, but I can’t provide it, I’ll point you to who can. If you’re well served as is, I’ll tell you.

We’ll stay friends.

It’s like the insurance lizard says, “A few minutes can save you thousands.”

And that’s not bullshit.

Articles from Paul "Pablo" Croubalian

View blog

This is the seventh post in the MisAdventures in Mid-Life Dating series. Some of you may be thinking ...

I sort of hijacked Nicole Chardenet's "Adventures · in Mid-Life Dating," · series. · You know what t ...

You know browsers. They're those thingies that let you surf the net. There's nuthin' to them. Right? ...

Related professionals

You may be interested in these jobs

-

food counter attendant

Found in: Talent CA 2 C2 - 1 day ago

Tim Hortons Ottawa, CanadaEducation: No degree, certificate or diploma · Experience: Will train · Tasks · Clear and clean tables, trays and chairs · Load buspans and trays · Package take-out food · Portion and wrap foods · Prepare, heat and finish simple food items · Serve customers at counters or buffet ...

-

Online Backend Development, Frontend and Backend Development, Database, API, SQL, MySQL Database, SQL RDBMS, Flask tutor

Found in: beBee S2 CA - 3 weeks ago

TeacherOn Old Toronto, Canada Part timeI need someone expert in backend and frontend, APIs, and DataBase to help me with a project. I have attached the project details to this post. Submission deadline is April 1st. · Level: Bachelors/Undergraduate · Gender Preference: None · Meeting options: · Available online - via ...

-

kitchen helper

Found in: Talent CA 2 C2 - 5 days ago

1319891 B.C ltd. Kelowna, CanadaEducation: No degree, certificate or diploma · Experience: Will train · Work setting · Willing to relocate · Tasks · Bring clean dishes, flatware and other items to serving areas and set tables · Clear and clean tables, trays and chairs · Operate dishwashers to wash dishes, glass ...

Comments

Paul "Pablo" Croubalian

6 years ago #17

Thanks, Lisa

Lisa Gallagher

6 years ago #16

Louise Smith

6 years ago #15

Louise Smith

6 years ago #14

Or Gold bars in the cellar !

Paul "Pablo" Croubalian

6 years ago #13

We can talk about it when you're ready. I assume your speaking gigs will be spread far and wide geographically. You will need something secure, yet 100% mobile. You won't have control of the various venues' networks, so security and PCI compliance will be issues. Their networks are 100% secure, but the part you would have access to is usually about as secure as a wet paper bag. We'll need to look at cellular-based systems. Reach out when you're ready and I'll get to work for you.

Jerry Fletcher

6 years ago #12

On hold until new product developed. Don't take it in my consulting business. Since I'm upping my speaking I'll have to get set up. Recommendations re the "right stuff" for a road warrior?

Paul "Pablo" Croubalian

6 years ago #11

LOL, I hear ya, Buddy. It isn't paranoia if they really are out to get ya. LOL I just met a restaurateur who was paying over 5% on CC processing and the same thing for Visa and MasterCard DEBIT!!!!! That's robbery

Randall Burns

6 years ago #10

I'm not pointing any fingers Paul \ but it is such a quagmire that regardless what type of transaction is going on there is someone somewhere ready to "dip" in and skim something, (maybe I'm getting paranoid from some of the other info I've been reading about, stock market, blockchain, etc.) Maybe I'm just getting old and can't keep up, LMAO!!!

Paul "Pablo" Croubalian

6 years ago #9

Actually, the predators aren't the merchants. We, the consumers, are the predators. We inadvertently screw over small business every day. The next post will explain that.

Wayne Yoshida

6 years ago #8

Message sent. Thanks!

Paul "Pablo" Croubalian

6 years ago #7

Thanks, Pascal.

Paul "Pablo" Croubalian

6 years ago #6

Thanks, Jerry. So, how are you set up for plastic?

Paul "Pablo" Croubalian

6 years ago #5

Thanks, Wayne. So, you guys accept CCs?

Wayne Yoshida

6 years ago #4

Randall Burns

6 years ago #3

Pascal Derrien

6 years ago #2

Jerry Fletcher

6 years ago #1