How To Love Being Audited . . . Really!

Obviously, I’m not talking about loving a tax audit here. There’s no way to love that. I’m talking about a whole different kind of audit, an audit that is painless yet can save you a bunch of money.

I’m talking about a payment processing audit. There’s an easy way to do it and a slightly harder way. Here, I’ll go over the slightly harder DIY way. A little further down, I’ll tell you the easy way.

Starting from a weak foundation

We’ve all done it. When you first start out, you’re faced with a mountain of paperwork. You need to plow through: articles of incorporation, shareholders agreements, tax documents, employer documents, construction permits, licensing documents, and a partridge in a pear tree.

You know you need to accept plastic so you sign a “standard agreement” while you’re opening your accounts and go back to that mountain of paperwork.

Yeah, we’ve all been there, done that, got the T-shirt, burned it, flushed the ashes down the toilet.

Meet “Sharon”

At least, that’s what we’ll call her. She asked to remain anonymous but allowed me to use her statement in this example. Sharon runs a B2B copier supply/repair business. She has techs that visit businesses to check their copiers and top up their supply of toner and/or paper.

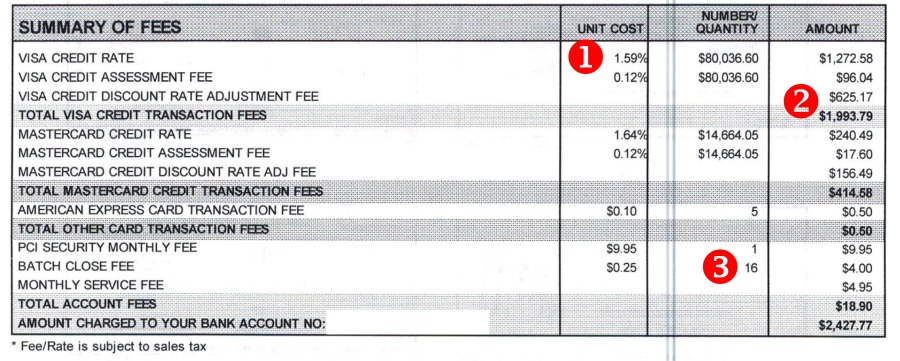

About 80% of her business is by corporate accounts and the other 20% is on credit card. She does about $100,000 a month on credit cards and this is her sanitized statement. Note that yours may be slightly different.

The Effective Rate Summary

![DETAILS OF DISCOUNT RATE ADJUSTMENT FEE

$1411.27]

8295250)

§ $5819 34

CON CORPORATE ELEC ¢ $4450 54](https://contents.bebee.com/users/id/10539615/article/how-to-love-being-audited-really/2aa717de.png)

Sharon thought she was paying 1.59%. We’ll see why in a minute. The truth is she was but as a base rate, not a flat rate. Sharon was on a pricing structure called “Interchange Differential”. She pays her base rate plus a differential surcharge that is the difference between her base rate and the actual interchange rate with a markup added.

The Fee Summary

Looking at position 1, we see why Sharon thought she was paying 1.59%, but the adjustment fee at position 2 belies that. While on the subject of the adjustment fee, 50% of the base fee is not alarming but warrants further investigation. The adjustment for MasterCard is even higher.

The high adjustment could simply be because the cards she processes carry higher interchange rates, or, there’s something wrong.

Looking at position 3 give us a hint. This statement covers a month with 31 days. Since Sharon operates 6 days a week, I would expect there to be 26 or 27 closes. There are only 16. Maybe she had days with no credit card sales, but that seems unlikely.

This is a smoking gun that screams for further investigation.

Credit card sales should be settled within 24 hours. If not, you get hit with a surcharge and increase the possibility of a contested charge. Go past 72 hours and it’s a bigger surcharge and an even bigger risk of a contested charge.

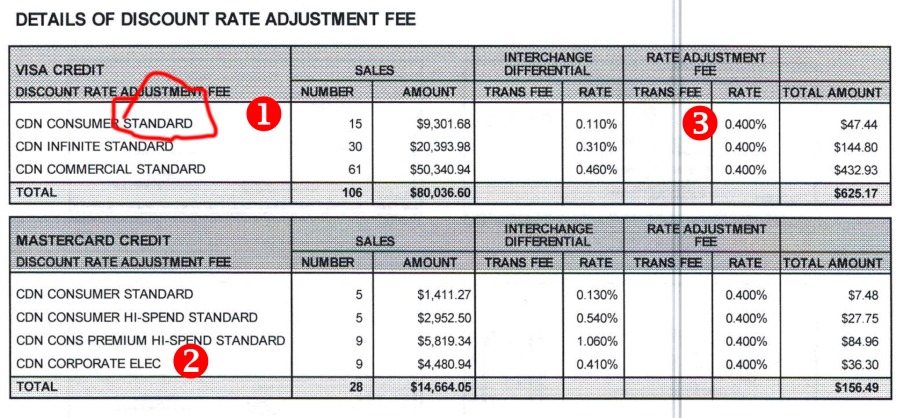

Adjustment Details

Position 1 - The word “standard” is worrisome. In normal speech, “standard” means ordinary or normal. In credit card speak it means surcharge. So does "settled." Out of 134 transactions, all but 9 faced a surcharge (position 2). Dollar-volume wise, 95.3% was subject to a surcharge.

A surcharge percentage that high points to a procedural issue. I called Sharon for clarification. Sharon admitted to sometimes forgetting to batch out her credit cards. I made a note to add automatic batching.

Then Sharon described her process.

- A tech does whatever he needs to do and presents a bill to the business owner. Those with house accounts simply sign it and add a PO#.

- For those who pay by credit card, the tech, card in hand, calls the office.

- He waits for someone in AR and gives them the payment info.

- AR keys in the info.

- When AR gets an authorization, the tech writes it on the bill, and the customer signs it

Pretty much every transaction is keyed in and subject to a surcharge. That’s easily and cheaply fixed. Further, there’s a hidden cost in employee time. While the two of them are working together to process a card, they aren’t doing other things. Even if it only takes five minutes, multiply it out by 134 transactions, times the two people involved and it becomes over 23 hours of labor.

That’s a lot of money even at minimum wage.

Position 3 - In this type of structure, the retailer pays their base fee plus a differential between that fee and the actual interchange rate if any. If the actual interchange is lower, they pay the base fee. Interchange rates go to the issuing bank, so the processor doesn’t get a penny if it’s higher than the base. The Rate Adjustment Fee gives the processor a little gross profit. Without some profit they wouldn’t stick around, would they?

What We Can Do for Sharon

Sharon’s business doesn’t qualify for any special interchange treatment. The normal rates apply. Luckily for us here, there are only seven fee codes.

Before we start anything, we need to equip her techs with mobile magstripe scanners for their smartphones. That’s those things that plug into the audio jack. They won’t need to call AR for authorizations anymore and Sharon won’t pay surcharges. She won’t pay all those wasted man hours either.

Sharon also asked for a new terminal since hers was getting rough around the edges. That wasn’t really necessary, but she’s the boss.

The new terminal, 15 magstripe scanners, and her setup fees were put on a 36-month lease for under $70 a month.

Sharon actually had a pretty good rate. I was only able to cut a couple of hundred bucks off it ($238.15). That comes out to $2,857.86 a year. It only took 15 minutes of Sharon’s time to realize that savings. What else can she do in 15 minutes that can make her $2,857.86 a year or more every year from now on?

She also saved all those wasted man hours.

As is usually the case, Sharon didn’t sit still. She decided to roll some of those savings into a loyalty program. Rather than go out of pocket, we added its setup costs to the lease too.

My promise to you

If you accept plastic, reach out. If I can help, I will. If you need help, but I can’t provide it, I’ll point you to who can. If you’re well served as is, I’ll tell you.

We’ll stay friends.

It’s like the insurance lizard says, “15 minutes can save you thousands!”

"""""

Articles from Paul "Pablo" Croubalian

View blog

As you · may have heard, I will be publishing · an eZine, "beBee's Best." The inaugural issue will b ...

Most MBAs are Masters of Business Administration. Those MBAs are good. The other MBAs, the Major Bul ...

I've been somewhat less prolific than usual lately. A second divorce will do that to a guy's muse. · ...

Related professionals

You may be interested in these jobs

-

construction helper

Found in: Talent CA 2 C2 - 17 hours ago

Alta Construction & Landscaping Services Ltd. Calgary, CanadaEducation: · Expérience: · Education · No degree, certificate or diploma · Work setting · Various locations · Construction site · Tasks · Load, unload and transport construction materials · Mix, pour and spread materials such as concrete and asphalt · Assist in drilling and bla ...

-

domestic housekeeper

Found in: Talent CA 2 C2 - 4 days ago

Agbo Chukwuemeka Ugochukwu Edmonton, CanadaEducation: No degree, certificate or diploma · Experience: 1 to less than 7 months · Work setting · Private residence · Tasks · Sweep, mop, wash and polish floors · Dust furniture · Vacuum carpeting, area rugs, draperies and upholstered furniture · Make beds and change sheets · C ...

-

Représentant(e) de territoire régional

Found in: Talent CA C2 - 17 hours ago

U-Haul Montreal, Canada Full timeLocation: · 2100 Rue Norman, Lachine, Quebec H8S1B1 Canada REPRÉSENTANT(E) DE TERRITOIRE RÉGIONAL · En avez-vous assez d'être enfermé(e) dans un bureau toute la journée? Cherchez-vous la flexibilité de gérer, planifier et effectuer votre charge de travail quotidienne par vous- ...

Comments

Paul "Pablo" Croubalian

6 years ago #3

Paul "Pablo" Croubalian

6 years ago #2

Thanks, Jerry. I'm just trying to lift the veil of confusion on what is, on the surface at least, considered "simple"

Jerry Fletcher

6 years ago #1