Saving for Retirement, can you hit your target?

How much do we need and should we save for retirement is a good question? The answer is based on a number of factors lifestyle expected and how long you expect to live. Each country and each individual will have a different approach to finding the right solution for this question. There are tools that provide us with rough guidelines that can help. England has one approach and Australia has another, both work as rough guidelines for those who are thinking about retirement or those who want to start actually planning for retirement. I thought about retirement for many years before I actually started planning for it.

In England, the most widely used measures of retirement income adequacy in the UK are the Joseph Rowntree Foundation’s (JRF) Minimum Income Standard (MIS) and the Pension Commission’s target replacement rate (TRR). MISs were developed in the UK and are based on feedback from a sample of the population on the types of goods and services they deem necessary for a socially acceptable minimum standard of living. The value of this standard ‘basket’ of goods and services is used to assess whether a person’s income is above or below this level.

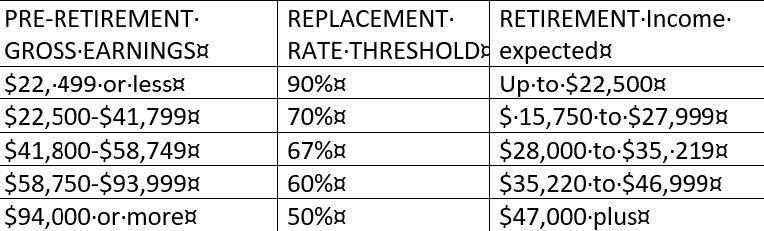

Currently, the level for single pensioners is £9,998.37 (~$23,497.00Canadian dollars) These measures indicate whether an individual is able to achieve a standard of living in retirement that is broadly comparable to that which the individual had during their working life. Income needs in retirement are typically lower than income needs in working life and, as a result, replacement rates are typically expressed as a proportion of the individual’s pre-retirement income. In the table below are the replacement rates suggested by these formulas. I have added a column and translated the amounts to Canadian income. The third column shows what a person could expect to see as a retirement income if they stayed within the parameters of the formulas.

TABLE 1: REPLACEMENT RATES USED BY THE PENSIONS COMMISSION These replacement rates are used by both the industry and policymakers to assess the adequacy of people’s current levels of saving for retirement. However, both sets of measures have substantial drawbacks. The JRF MIS is designed to only give an indication of the minimum income for a socially acceptable standard of living. Given that the State Pension, for most people, already provides most of this amount, and most people aspire to far higher levels of retirement income, it is of only limited use to savers.

PPI, What Level of Pension Contribution is Needed to Obtain an Adequate Retirement Income? (2013) In Canadian dollars

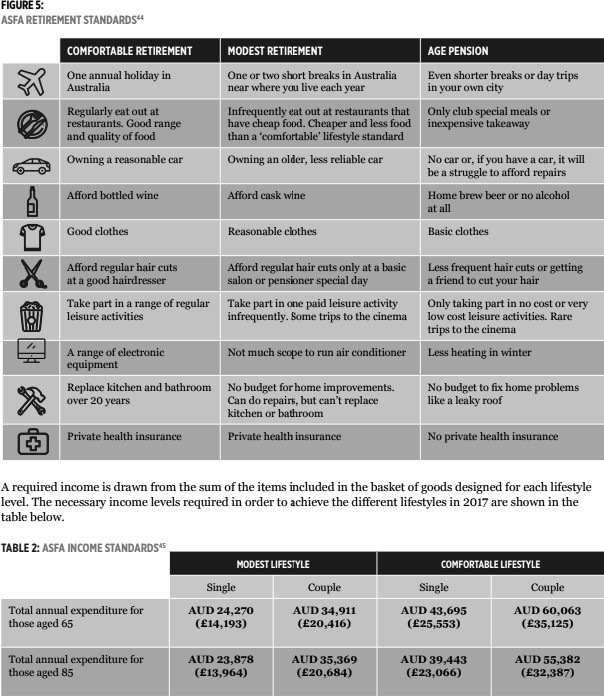

In 2004, the Association of Superannuation Funds of Australia (ASFA) introduced the Retirement Standard. The ASFA Retirement Standard was developed in order to help people plan for retirement, given that research suggested that many people struggle when it comes to developing a budget for their future needs, especially when their retirement is many years away.

It does this by outlining three distinct income levels, as well as the sorts of goods that can be purchased with each. The first income level is tied to the Australian State Pension, the Age Pension. The second and third income levels identify the sort of goods and services that can be purchased with a ‘modest’ and ‘comfortable’ retirement income.

For the ‘modest’ and ‘comfortable’ levels, ASFA has constructed estimates of the annual budgets required by individuals to fund the chosen standard of living in post-work life. The ASFA benchmarks estimate the budgets required by both singles and couples in order to enjoy a ‘comfortable’ and ‘modest’ standard of living in retirement.

They are updated quarterly to reflect changes to the Consumer Price Index (CPI) and also differentiate between older and younger retirees, who often have different needs that require appropriate funding. For each retirement standard, a basket of goods is constructed taking account of expert opinion, national surveys of expenditure and focus groups. The Australian model shows at a glance what your retirement lifestyle would look like and the amount of money you would need coming in to sustain that lifestyle.

In Canada and many other countries, people do not know how much they need to save for retirement. This is not a big issue as there are many planners who can help them. However, if there were an unbiased system that showed us a target like the one that is in a place like Australia, then people could be objective. A set of targets could give us a clear and understandable goal. On the basis of this goal, savers would then be able to calculate the amount of savings necessary to deliver the target income.

In January 2018 The Pensions & Lifetime Savings Association and the Hitting the Target Steering Group issued a report (pdf file) on the idea of targets and said “We envisage that the body which calculates the National Retirement Income Targets would host a range of bespoke tools which would allow a saver to select their preferred retirement income target level and be adjustable according to their age, whether the person is in a household made up of one or more people, and the cost of living where the person lives.

In the many cases where people will only be relying on pension saving to achieve their target income, it will be possible to adopt and promote standard rules of thumb. In more complex cases, where people are able to draw on a wider range of assets, e.g. property, inheritance or other savings, the targets could be used in conjunction with online tools which would support savers, and where applicable their advisors, in planning their retirement income.”

Articles from Royce Shook

View blog

My thanks to Aubrey and Ron for the following stories which will be posted over the next few days. · ...

I was sent this by one of my high school friends, I added to it and thought I would share · 1. · I w ...

Managing and accepting change can be a difficult but inevitable aspect of life. As we age, the pace ...

You may be interested in these jobs

-

factory helper

Found in: Talent CA 2 C2 - 1 day ago

Accurate Aluminum Ltd. Burnaby, CanadaEducation: No degree, certificate or diploma · Experience: Will train · Tasks · Transport raw materials, finished products and equipment throughout plant manually or using powered equipment · Perform other labouring and elemental activities · Clean machines and immediate work are ...

-

Wraparound Facilitator

Found in: Talent CA C2 - 3 days ago

Island Health Victoria, Canada CasualQUALIFICATIONS: Education, Training And Experience · Baccalaureate Degree in a health or a human services related discipline, including counselling content, from an approved post-secondary institution. Two (2) years recent experience in a strengths-based case management or wrapar ...

-

Management Trainee

Found in: beBee S2 CA - 3 weeks ago

Enterprise Mobility Montréal, Canada TEMPORARYOverview Start your career with Enterprise We're hiring immediately for our respected Management Training Program. · Whether you see yourself in sales, business development, customer service, retail management, or operations, as a manager in training, you can count on a career ...

Comments